Thinking about releasing some cash from your home in the year ahead? You might be surprised to learn just how popular

equity release has become over the past few years, as more and more people have decided to incorporate it into their retirement planning. We’re taking a look at some of the most important statistics from the past year, so that you can see how and why the market is growing – and what it means for you.

2017 was a record year for Key's customers

Taking all of our customers together, we’ve helped homeowners to unlock just under three quarters of a billion pounds in 2017.

Last year, 11,000 homeowners just like you released cash totalling £711,960,715. That's an average of £63,968 released for a huge variety of different reasons - from jetting off on a dream holiday to making improvements that will transform a home.

Equity release has also become popular as a way of funding stay-at-home care, allowing some of our customers to stay in their own homes despite health concerns. As large numbers of interest-only mortgages begin to mature, it can also help people to free themselves from these looming repayments.

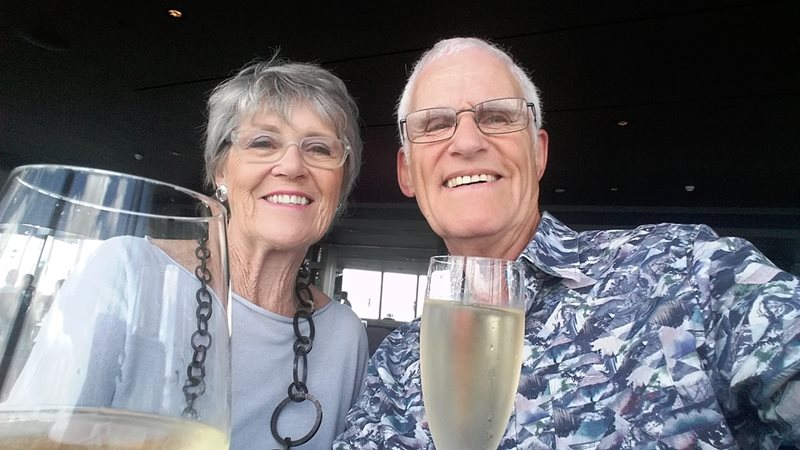

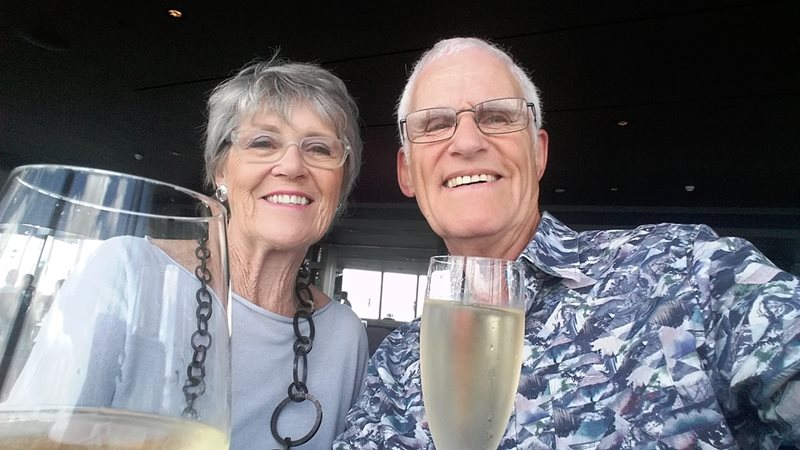

Equity release can have a big impact, and many of our customers let us know how they're getting on once the money comes through.Recently, we caught up with John and Gillian; they chose to release equity after their pension fund fell short, and since going ahead they've been able to make home improvements and afford a trip to Australia.

You can read their full story here.

How much cash is tied up in your home?

If you're interested in releasing equity from your home then why not use our calculator to see how much could be available?

Calculate now

Finally, we welcomed lots of great new people into Key over the past year, including plenty of new advisers. This means that there are more experts available to help should you decide to learn more about

equity release, and more people on hand to support you if you go ahead with an application. Unless you decide to go ahead, Key's service is completely free of charge as Key's fixed advice fee of £1,299 is only payable on completion of a plan.

If you are thinking of going ahead with

equity release, read '

Is it right for you?' carefully to get all of the facts - including how

equity release will reduce the value of your estate and may affect your entitlement to means-tested benefits. You'll also learn how the most popular type of

equity release plan, a lifetime mortgage, is a loan secured against your home.