7.5 million Over-55s looking to Adapt Homes for Care Needs

17 December 2021

- Average bill for future proofing would be more than £7,600

- But nearly one in five estimate they’d need to spend more than £10,000

Others (6.2 million or 30%) will be looking to move home or have resigned themselves to managing in their current property without making any adaptions (2.6 million or 13%). With two thirds (63%) of over-55s wanting to receive care at home, those who intend to adapt their homes anticipate spending spend an average of £7,600

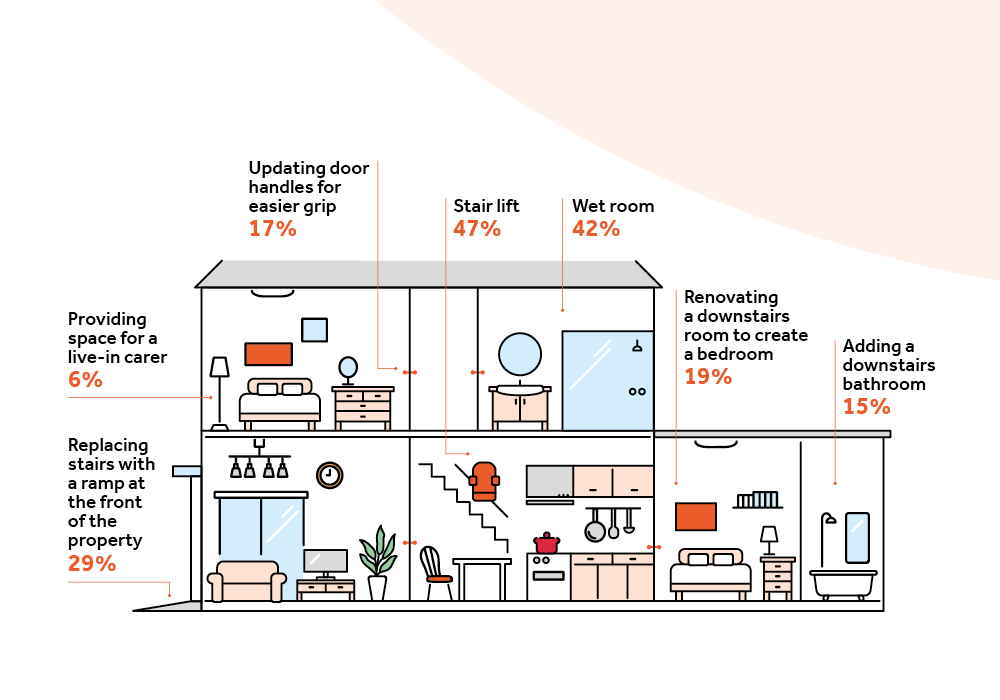

Stair lifts (47%), wet rooms (42%) and replacing external stairs with a ramp at the front of the property (29%) were seen as the most likely adaptations needed but renovating a downstairs room to make it a bedroom (19%) or bathroom (15%) were also considerations.

| FUTURE PROOFING HOMES FOR LATER LIFE | HOW MANY EXPECT TO |

| Installing a stair lift | 47% |

| Converting a bathroom to a wet room | 42% |

| Adding a ramp | 28% |

| Turning a downstairs room into a bedroom | 19% |

| Installing easy to grip door handles | 17% |

| Adding a downstairs toilet | 15% |

| Redesigning home for a live-in carer | 6% |

More than one in five (21%) believe they will need to find more than £10,000 to adapt their home to meet their needs in later life. Others (16%) are in a relatively fortunate position that they believe any improvements to their home will cost less than £1,000.

Will Hale, CEO of Key – the UK’s largest equity release advice firm, commented: “Most people want to be able to stay in their own home if they need care in later life and for 7.5 million over-55s this is going to mean needing to adapt the property to meet their needs. Arguably, this number may even be higher as while some people intend to move, the UK simply does not currently have enough suitable housing stock to meet their needs.

“Whether it is relatively straightforward work such as installing easy grip door handles and ramps or more complex work such as converting bathrooms or turning downstairs rooms into bedrooms, this comes with an average price tag of £7,500 which well may be difficult to fund out of retirement income. Using housing equity to make the home you want to stay in more functional for your needs as you age only seems to make sense as it allows you to use what is often your largest asset to maintain the level of independence that you want.

“The first step should be to speak to a specialist adviser who will provide you with support as you consider all your options before finding the right one for your individual circumstances.”

Anyone looking to release equity from their home can get Key’s independent guide to equity release by calling 0800 531 6027 or visiting https://www.keyadvice.co.uk/equity-release/is-it-right-for-me